Melbet is one of Kenya’s best betting platforms. GAMETOSHA LTD owns MelBet Kenya. The BCLB licenses it under the lotteries and gaming act cap 131 laws of Kenya.

Its license number is 0000332. It also has a public gaming license number 0000223 for casino operations. Like other betting sites, Melbet operates under certain tax regulations. Melbet company is not a tax-free betting site.

The Betting Control and Licensing Board (BCLB) regulates betting in Kenya. All licensed betting companies must follow the government’s tax rules.

It’s crucial to note: Kenya taxes winnings from betting sites. This includes international platforms for Kenyan users. Also taxes the bet placed.

In some cases, payment systems charge fees for deposits and withdrawals. MelBet usually pays these fees, but may charge them to some customer accounts. The fee is not part of the taxes imposed.

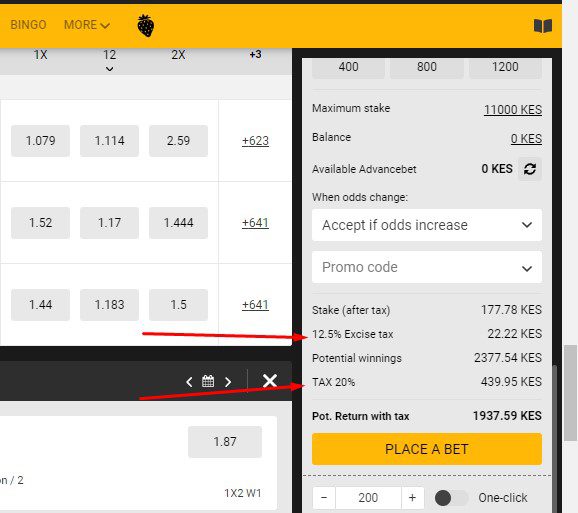

Here are the applicable various taxes in Melbet:

Excise Duty

- The Finance Act 2021 introduced a 12.5% excise duty in June 2021. This means that for every Ksh. 100 wagered, the Kenya Revenue Authority (KRA) deducts Ksh. 12.5, regardless of whether the bettor wins or loses.

- Excise duty is a legislated tax. It is imposed on specific goods or services when they are purchased.

- Businesses primarily pay excise taxes. These businesses then pass the tax burden on to consumers.

20% Tax on Winnings

- Additionally, players must pay a 20% tax on all successful bets. For instance, if you win Ksh. 1000, KRA will deduct Ksh. 200, leaving you with Ksh. 800.

- Every winning bet is liable to the 20% cut on tax.

Betting sites without tax in Kenya

Are there betting sites without tax in Kenya? Unfortunately, there are only legal betting sites with taxes in Kenya.

If you find a betting site that does not have all the tax charges, it is operating illegally in the country. The site is not licensed or registered in Kenya. So, it is unsafe and untrustworthy.

There may not be specific tax-exempt betting sites in Kenya. But, users should be aware of potential tax obligations from betting. This applies regardless of the platform they use.

However, there are a few exceptions where some betting platforms offer tax-free opportunities. Let’s explore them:

-

1xBet: This is the only betting site for Kenyans that does not charge tax. When you play on 1xBet, you get all your winnings. Your stake stays the same.

-

Paripesa offers a 100% bonus on your first deposit. The company caps the bonus at 11,800 KSh.

-

Helabet: Provides a 100% bonus, capped at KES 10,000. To unlock the bonus, wager it 15 times at minimum odds of 3, allowing for a top payout of KES 40,000. Bets within the bonus exclude virtual games.

-

Betgr8 is not 100% tax-free. But, it allows you to place bets without taxing your stakes and winnings.

Remember to choose your betting platform wisely and gamble responsibly!

The Kenyan government sets the terms for the taxes on the betting platform. Melbet follows BCLB terms of taxation.